How Athletic Brewing Disrupted a Dead Market

A case study in building category leadership from the outside in.

Build to Thrive is your go-to for business & real estate insights—stories, playbooks and trends. We spotlight trailblazers & deliver actionable strategies to drive success. No fluff, just useful stuff!

Key Concepts:

#BusinessModelInnovation | #GoToMarketStrategy | #CategoryCreation

#TeamCulture | #OperationalExcellence | #VisionDrivenGrowth

For decades, non-alcoholic beer was like decaf coffee or sugar-free cookies—technically correct, but never anyone’s first choice. It was beer for people who couldn’t drink, not beer you’d actually want to drink. Then came Athletic Brewing—and redefined what beer could be.

A Personal Shift

Bill Shufelt’s journey from hedge fund analyst to beer industry disruptor began with a deeply personal decision. “I stopped drinking in 2013 and felt enormous positive effects on my life,” he shared on The Founder Spirit podcast. But even as his health improved, he still missed the flavor and ritual of beer. The options on the shelf—O'Doul’s, Kaliber, Heineken 0.0—didn’t meet the mark. “I was frustrated by the lack of great tasting, non-alcoholic beverage options, and determined to create an innovative beer for today’s healthy, active adults.”

From Frustration to Vision

By 2016, Shufelt’s motivation went beyond personal preference—it was also strategic. “At the time, non-alcoholic beer was only 0.3% of the US beer market. But I thought there was huge pent-up demand for great tasting, non-alcoholic beer,” he explained in The Split. That market insight sparked a mission: to not just improve NA beer, but to reinvent it. As he later put it, “It’s not just about brewing non-alcoholic beer; it’s about crafting fulfillment and revolutionizing the non-alcoholic beer segment.” (The Founder Spirit)

Non-alcoholic beer has existed for decades. But it was never taken seriously—not by brewers, not by drinkers, and certainly not by brand builders. It was crowded with low-flavor, low-loyalty, often stigmatized products. Athletic didn’t join that space. They created something else entirely, a lifestyle-driven, craft-quality, performance-aligned beer experience that happened to be non-alcoholic.

Like the Blue Ocean Strategy playbook, the now-classic book that challenged businesses to stop competing in crowded markets and instead create entirely new ones. Athletic Brewing is one of the clearest examples of that idea one could ever come across.

Turning Conviction Into Action

In 2017, Bill’s first attempts at homebrewing fell flat—literally. He tried to craft a great NA beer with a stovetop kit and borrowed gear, but the results were weak, inconsistent, and far from drinkable. Still, he kept at it, reading brewing manuals and obsessing over every failed batch.

Eventually, he realized the technical challenge of brewing under 0.5% ABV while preserving flavor required more than persistence—it required partnership.

He found John Walker, a craft brewer with a reputation for balance and precision. Bill was looking for more than technical help—he needed a true partner, someone who could match his ambition and bring artistry to the vision. At their first meeting, what started as a conversation about brewing quickly turned into a shared mission. They both believed beer didn’t have to be alcoholic to be meaningful—and that the industry was ripe for reinvention. Within weeks, John left his job to help build something neither of them could do alone.

When the Idea Clicked

Their breakthrough came in a small, rented space in Stratford, Connecticut. With limited capital, they began testing brewing methods using modified equipment, aiming to create real beer that just happened to be under 0.5% ABV—not watered-down lagers or post-brew alcohol extractions. It took over a year of trial and error—testing yeast strains, adjusting temperatures, rebuilding flavor profiles from scratch.

John’s craft brewing pedigree proved essential. He treated each batch like a flagship IPA. Bill’s background in finance helped them stay lean and strategic—he raised just enough capital early on from friends and family and resisted the temptation to scale prematurely. One pivotal moment was a taste test at a local event: people didn’t just tolerate the beer—they asked where to buy it.

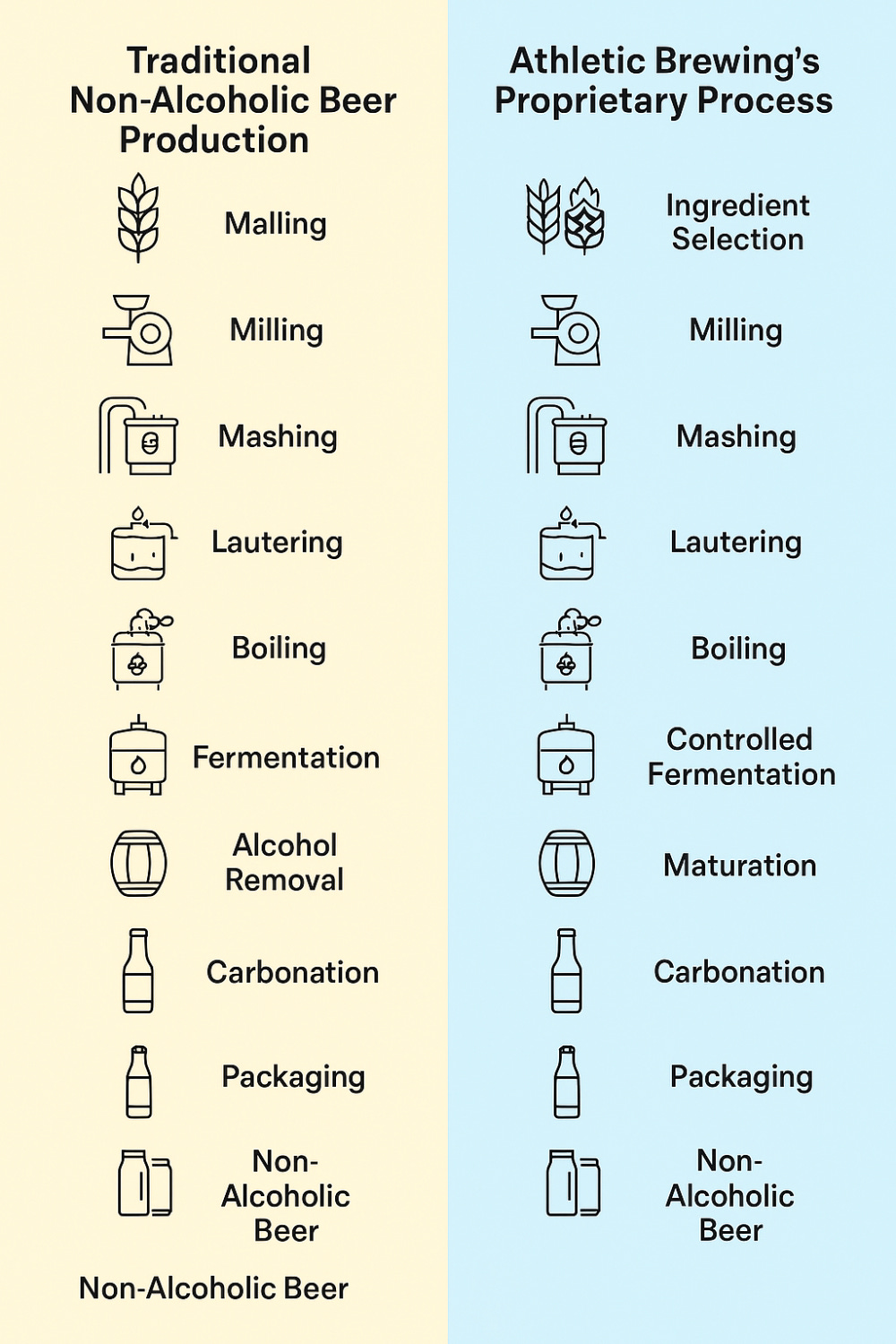

Rethinking the Brewing Process

Most non-alcoholic beers are made by brewing traditional beer and then removing the alcohol—either through heating (which can dull flavor) or vacuum distillation. This process often leads to flat, uninspiring taste and a thin body.

Athletic Brewing flipped the script. Their proprietary method starts with purpose-built recipes designed to ferment to less than 0.5% ABV naturally. This means:

Special yeast strains that limit alcohol production

Precise control of mash temperature and fermentation

No need for post-brew alcohol removal, preserving flavor and aroma

In short, they didn’t strip out alcohol from real beer. They brewed non-alcoholic beer as a craft product from the ground up.

Meeting the Market at the Right Moment

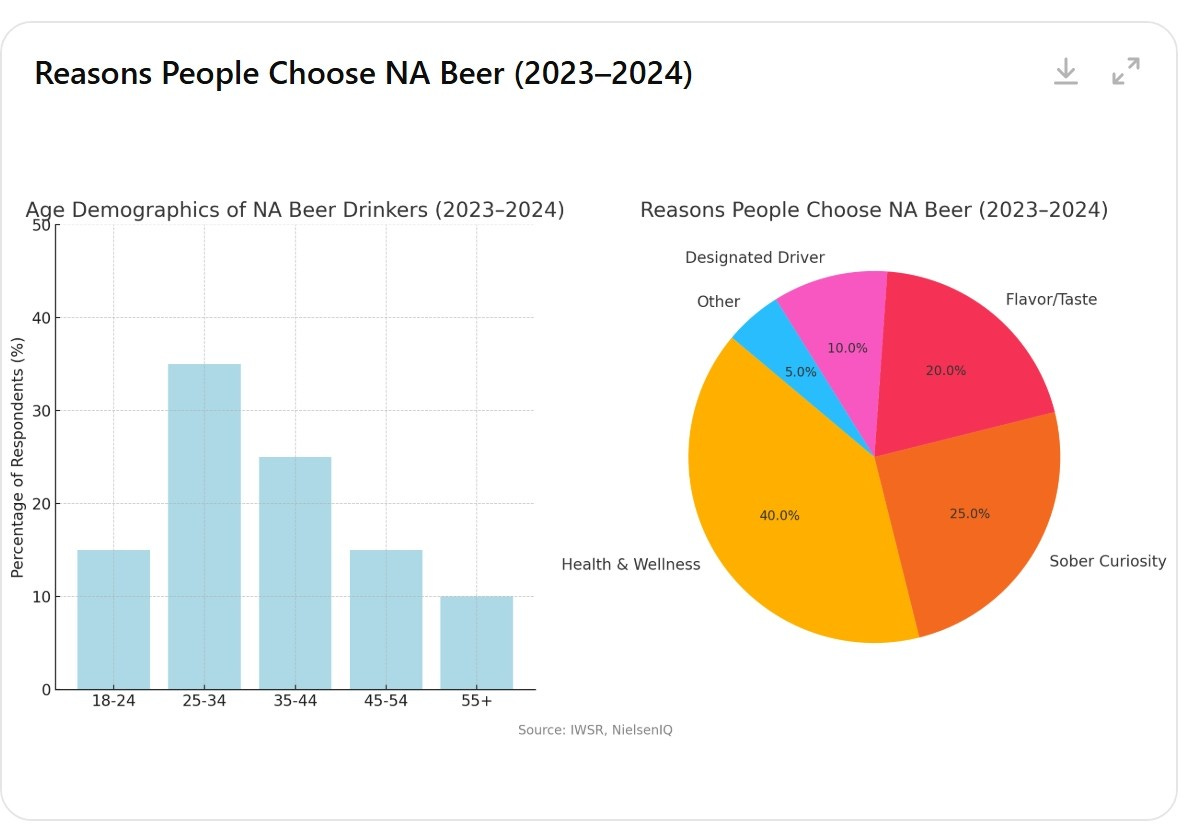

In 2020, the non-alcoholic beer segment was still a sleepy corner of the industry. U.S. sales were flat, legacy brands like O'Doul’s dominated, and consumer perception was lukewarm at best. But broader forces were brewing:

The rise of the sober-curious and “mindful drinking” movements

Increasing health consciousness around sleep, stress, and performance

Younger consumers embracing moderation and purpose-driven brands

Bill had sensed this early. “People are changing their habits,” he told Fast Company. “They're not drinking less just because they’re forced to—they're being intentional about it.”

Athletic’s success came not just from timing—but from conviction. They didn’t position themselves as the non-alcoholic alternative. They framed themselves as the better choice—for performance, flavor, and lifestyle.

This identity was clear in their branding. They leaned into the culture of movement—morning runs, mountain hikes, finish lines without hangovers. Their brand felt more Patagonia than Pabst Blue Ribbon—adventurous, purpose-driven, and tied to real communities. Through their Two for the Trails initiative, they donated over $2 million to environmental causes.

In 2021, major retail partnerships with Whole Foods and Total Wine signaled industry validation. That same year, investments from TRB Advisors and Keurig Dr Pepper fueled their ability to scale operations.

A review of challenges and key decisions

Rapid growth brought real challenges. According to interviews with Shufelt and public reporting in Brewbound, Fast Company, and CNBC Make It, the path from garage brewery to national brand was paved with tough operational decisions.

Hiring and Culture (2019–2020) Scaling meant more than adding staff—it meant building a culture. From the outset, Shufelt prioritized hiring talent aligned with Athletic’s values: wellness, transparency, and execution. He also made it a point not to go it alone—bringing in leaders with craft beer and CPG experience to build a company that could scale from the inside out.

Systems and Processes (2019–2021) To keep pace, the company implemented SOPs early, established rigorous brewing protocols, and adopted digital tools to monitor quality and logistics. These systems helped Athletic maintain consistency while growing across multiple markets and time zones.

Distribution Complexity (2020–2021) Distribution was another major hurdle. Transitioning from local delivery to a full-scale national operation required negotiating with third-party logistics firms for temperature-controlled transport. According to the New York Times, Athletic developed a blended strategy: combining old-school regional distributors with direct-to-consumer e-commerce infrastructure.

Industry Pushback and Setbacks Their growth wasn’t without friction. Early on, Athletic faced challenges getting shelf space traditionally reserved for alcoholic beer. Distributors and bar owners were skeptical of giving real estate to a NA product. Competitors began releasing upgraded versions of their own NA beers in response to Athletic’s rise.

Regulatory Navigation and Supply Chain (2019–2022) Non-alcoholic beer still falls under alcohol regulation in many states. Athletic had to navigate a patchwork of compliance standards, all while managing a cold chain supply network. Every decision—from how much inventory to hold, to how to price and label their products—had to be managed across a fragmented system.

The COVID Pivot (2020) When the pandemic hit, traditional distribution channels like races, gyms, and bars shut down. Athletic responded by pivoting aggressively to e-commerce. They launched a robust subscription model, strengthened their online store, and produced digital content that helped them maintain a strong connection with their growing audience. While many breweries suffered, Athletic’s shift to DTC helped them not just survive—but thrive.

These decisions weren’t glamorous, but they were essential. They formed the backbone of a company designed not just to grow—but to last.

By 2022, just five years in, Athletic Brewing cracked the top 50 U.S. craft breweries by volume—a first for a non-alcoholic brand. That same year, they ranked #26 on the Inc. 5000 list, boasting 13,071% revenue growth in three years.

In 2023, they broke into the top 10 U.S. craft breweries overall.

And by 2024, they weren’t just expanding globally and releasing hop-infused seltzers—they were changing how people thought about beer.

What It took Athletic Brewing to Disrupt a Legacy Industry

See the category differently Don’t just make a better product—redefine the category. Athletic Brewing didn’t try to fix NA beer; they made it aspirational.

Outsiders have an edge Bill wasn’t a brewer, and that helped. He challenged assumptions, reframed the audience, and built from first principles.

Hire for your blind spots Scaling fast required experience. Bill brought in experts from both CPG and craft beer to build a strong operational foundation.

Culture is a scaling system Athletic’s values—wellness, transparency, execution—weren’t slogans. They shaped hiring, decision-making, and resilience under pressure.

Partnerships are leverage From logistics firms to national distributors and aligned investors, smart partnerships helped Athletic punch above its weight.

Build systems before you need them SOPs, QA, logistics, and tech infrastructure were in place early—ready for growth when it came.

Pivot fast, don’t flinch COVID disrupted everything. Athletic turned hard into e-commerce, launched subscriptions, and came out stronger.

They didn’t just brew great beer. They built a movement.

SOME DISRUPTORS OF LEGACY INDUSTRIES

What These Disruptors Have in Common

Started Outside the System

Targeted an Overlooked or Underserved Market

Reframed the Value Proposition

Built Emotionally Resonant Brands

Changed the Rules of Distribution or Experience

Why This Story Matters to Builders

Athletic Brewing’s journey is a masterclass in what happens when you challenge assumptions, solve for the overlooked user, and build systems to support explosive growth — all lessons deeply aligned with the B.U.I.L.D. method, which is a tenet of this publication.

B reak down the challenge (boring, stigmatized non-alcoholic beer)

Uncover the hidden leverage (rising health consciousness + lifestyle branding)

I magine a strategic path forward (build a new category, not fix an old one)

L ay the execution roadmap (craft brewing precision + early systems + fast pivots)

D rive results with structure and accountability (from garage to a disruptor in under a decade)

Athletic didn’t just enter a market. They changed how people thought about it.

What to Ask Yourself

If you’re building something today, ask yourself:

Am I fixing something that’s broken — or creating something entirely new?

Am I preparing my systems now — or waiting for growth to overwhelm me?

Because finding an opportunity is one thing.

Building a movement? That’s what endures.

Until the next edition —

Build smarter. Build with intention.

Have feedback or a story you’d like me to cover? I'd love to hear from you.

Until the next edition.

Juan Salas-Romer

Readers who enjoyed this article, also enjoyed reading these ones:

What is takes to turn a cooler into a $2B dollar brand

What It Takes to Turn a Small Bake Shop Into a $500M dollar business National Phenomenon

Sources: The Founder Spirit Podcast, The Split, Fast Company, CNBC Make It, Marketing Dive, The New York Times, Brewbound, Inc. 5000 Lis

Disclaimer: The insights and analysis in this article are based on publicly available information, interviews, and reports from various sources. While every effort has been made to ensure accuracy, some interpretations are inferred and may not fully reflect the perspectives of Bill Schufelt or the complete details of his journey.

Feel free to use the chat to share your opinions, comments, future topic suggestions or questions.

Don’t hesitate to pass this article along to someone who might find its content helpful or useful.

About the Author

Juan Salas-Romer is the Editor of Build to Thrive and the President & CEO of NHR Group, a real estate investment and development firm focused on transformative real estate and business turnaround projects. An award-winning investor and business development leader, Juan brings over 20 years of experience driving companies from inception to 7-figure revenues across the finance, real estate, hospitality, and education sectors. His work sits at the intersection of economic growth, innovation, and community impact. Linkedin bio: Juan Salas-Romer

© 2025 Build to Thrive. All Rights Reserved.